In this article we will break down all of the costs associated with a VoIP phone service bill each month and provide an explanation for each one, including service pricing, taxes and regulatory fees. This will help you understand the true cost of VoIP phone services, and more importantly why we recommend getting multiple quotes up front, whether for home or business.

How Does VoIP Pricing Work?

Before we get into all the various fees associated with your VoIP bill lets quickly go through how phone service pricing works in general.

Residential Plans

The residential VoIP phone sevice market is very competitive. This makes it good for the consumer as providers get into price wars and try to be the cheapest option around. Most providers will advertise their lowest monthly rate. For home services this is typically a combination of plan type and length of contract, for example annual pre-pay.

Plan Type

For residential service this is fairly straight forward and the most common plan type is a USA unlimited calling plan at a fixed monthly rate. You pay the same rate each month and it includes all your calls in the USA (local and long distance) and typically incldes 30+ features at no additional cost.

Some providers may have more than one plan, for example they may have a 500 minute per month usage plan, an unlimited USA calling plan, and a world calling plan, each with a different monthly rate. Based on what fits your needs you select that plan and that is the base pricing of your VoIP bill. In most cases you can simply switch to a different plan if your needs change.

Note that plans that have a limited amount of minutes included, for example a 500 minute plan, can also charge what is called overage for any additional minutes you use in a given month over and above the limited amount included with the plan.

Service Length

The most common options that home providers offer for service length are monthly or an annual pre-pay option. With annual pre-pay you simply pay for the years service up front, with discounts in the 20% range. Providers often advertise a monthly rate based on the annual pre-pay amount divided by 12.

So the first thing to be aware of when selecting a solution is what is the plan type and length of plan service you are signing up for. If you want to pay monthly and have no term commitment then you will most likley pay higher than the advertised rates.

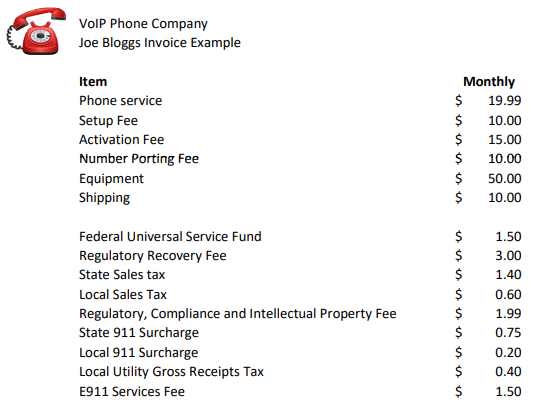

One Time Fees

Some providers charge certain one time fees on signup, as detailed below. These are worth mentioninig here for completeness but they will not appear on your regular phone bill after your initial signup fee is paid. However, these fees can raise your average monthly rate for the first year when included in the calculations so they should be considered when comparing options.

- Setup Fee

- Activation Fee

- Analog Telephone Adapter (ATA) Fee

- Shipping Fee

- Number Porting Fee

Many providers offer a free ATA device for their service, but be aware that this is typically a "free lease". If you cancel service with them you will be required to send it back in its original packaging. So keep that box safe just in case! If you do not send it back you will typically be charged a restock fee for the device, around $50 but it can be higher.

Business Plans

Business service pricing is a little more complicated with a few more factors that need to be considered, including plan type, number of users, length of service, optional features, and hardware such as IP phones.

Plan Type

Like the home market the most common plan type is a USA unlimited calling plan with a fixed monthly rate. Some providers have multiple plans at different rates. In the earlier days plans were differentiated by limited minute plans or metered plans (where you paid per minute usage). However, as the technology has exploded these type of plans have been replaced with plans that are differentiated by the included features.

Whatever plan type you choose it will have a basic monthly rate that is the basis of your phone bill. However, that rate can be different depending on several factors.

Number of Users

Once you have picked your plan type the actual monthly cost will be based on the number of users of your phone system. For example, let's say the company had 5 employees all needing a dedicated phone, this would equate to 5 times the per user monthly rate. It is not always clear cut, as its not necessarily the number of employees but a user is someone that requires a phone line. For example, you could have 20 employees but only 5 employees require a phone line. In this instance it would be equivalent to a 5 user system and thats what you would pay for. You could also have some phones in common areas like break rooms, and again this is typically not a user so would be either a free or discounted extension.

To make things a little more complicated many providers have tiered rates based on the number of users. A company with twenty (20) users may pay $20 per user per month and a company with three (3) users may pay $25 per user per month, whereas a sole proprietor may pay $30 per month for a single user.

Service Length

Another factor that affects pricing is the term you sign up for. If a provider offers options for service length then selecting a month to month option will most likley be a little more expensive than longer term agreements. Some providers may offer a 1 year, 2 year, or 3 year contract agreement, each reducing the monthly rate by a given amount.

Other options may include annual pre-pay, similar to what home providers offer. This typically gets you a slightly lower average monthly rate also.

Optional Features

Some providers do offer add-on features at small incremental per month pricing. Some examples include call recording, Internet Fax, Toll Free plans, International calling plans, and conferencing (voice, video etc.) features. More recently this pricing factor has become a part of the plan type differentiation mentioned above, especially with the introduction of UCaaS services (Unified Communications).

This is less common than it used to be but is still something we recommend to confirm before you sign up for a service.

Capital Costs

The main capital cost is purchasing IP phones, plus any network equipment needed (e.g. routers, switches etc.) and any cabling required (Ethernet cable drops etc.). Most home services utilize ATA's and allow use of the existing home phones in place. With business though you want the best quality audio as well as the best features, which means using IP phones.

IP Phones can, in most cases, be bought directly from the service provider you choose. The provider pre-programs the phones and ships them direct to your business address. Options vary from the $50 range for basic work horse phones to $200+ for executive (color touch screen displays) or speciality models like conferencing phones.

Some providers may include phone rental into their monthly rate, saving you from any up front costs. However, you should do the math in case you end up paying more in the long run.

As technology advances there are providers that allow you to run your phone system purely with your employees smart devices, such as smartphones and laptops, by offering Softphones and Mobile Apps. A Softphone allows you to make and receive calls using your PC/laptop and Mobile Apps offer an extension to your business phone system on your Smartphone. This can also save you the up front costs, but requires that employees have access to their own personal smart devices or you may need to provide them, which can be costly.

One Time Fees

Similar to home services there are some one time costs typically associated with a business solution. Each provider is different but here is a list of some that you should verify before signup.

- Setup Fee

- Activation Fee

- Shipping Fee

- Number Porting Fee

Price Match Guarantee

You have to remember that most providers want your business. Getting free quotes from multiple providers puts you in a stronger bargaining position. If you have your heart set on a particular provider but you have a lower quote from a competitor you can always ask your preferred provider to price match. Providers may include a special discount to win your business.

Tax and Regulatory Fees

Above we provided a breakdown of the basic VoIP phone service costs and the different factors that can affect the "average" monthly rate you pay. That was the easy part! The next part of your VoIP bill can be confusing for many and the most important thing to know is that these additional costs can vary by provider!

As these fees are common between all VoIP providers, whether residential or business based, we will discuss each one here in this section below. Just know that they can apply to either service. Also know that it does not mean that ALL providers charge ALL of these fees. Some of these fees are provider dependant, and hence why they can be different per provider. One reason for this is that some providers incorporate some recovery fees into their per month rates, rather than charging for them as a per line item.

Sales Tax

Let's start with the easiest one that most people will understand, sales tax! Most states (except five) in the USA have sales tax which generally consists of a states sales tax and a local sales tax (county/city level, and can sometimes be both). VoIP phone services are charged as retail sales tax. Your provider will charge you retail sales tax based on your address and zip code.

The provider will pay this to the relevant authorities on your behalf. Some providers may even pass down other state taxes, for example B&O Tax, that are imposed on them for additional items like number porting and shipping revenue.

911 Surcharge

This can sometimes be referred to as simply E911 Tax. This is a tax assessed by state and/or local taxing authorities in the USA on VoIP services. It is used to fund E911 services at the state and local levels. Typically there is a state fee and a local fee that gets combined into one fee to the customer, although some providers may break it out into two line items (one for state and one for local).

VoIP providers collect this tax from their customers to pass onto the relevant authorities. Here is a good resource for 911 surcharge rates for VoIP by state to give you an idea of the fees.

E911 and Information Services Fee

The Emergency 911 or E911 Service Fee is a charge added by the provider and is not a government mandated fee, meaning that all the proceeds go to the provider. It is what is often called a type of "recovery fee" and some providers may refer to it as E911 Cost Recovery Fee. It relates to covering direct costs incurred by administrating E911 service to its customers.

Some providers include the Information Services Fee in this category which is another provider imposed fee for offering services for 411 dialing.

Not all providers charge these fees, and some may simply incorporate them into their monthly rate. This provider imposed fee typically ranges from $0 to around $3 per month.

Federal Universal Service Fund (USF)

Most providers are required by the FCC to contribute into the Federal Universal Service Fund in some form or another. This fee is based on a percentage of interstate usage, although to make things easier the FCC provides a safe harbor calculation (a fixed percentage of overall usage). Each year the provider is required to file forms with the FCC providing information on usage and locations (states) that it provides services to.

The FCC uses the USF contributions to directly fund things like rural bandwidth deployment, or access programs that bring phone and internet service to poor and underserved communities, schools and libraries, and other similar programs.

The FCC does not require these fees to be passed on to the providers customers but they do permit it. The percentage that the FCC charges goes up almost every year to cover their budgets. This contribution can start to eat into a providers profit margins so many simply pass it onto the customer. Others incorporate it into their monthly rates.

Regulatory Recovery Fee

Regulatory Recovery Fee can also be referred to as FCC Cost Recovery Fee, Regulatory Access Fee, or Federal Program Fee. Again, this is not a government-mandated fee and is a provider dependant charge.

If you do not see a Federal USF line item on your bill (or quote) then this item typically covers the USF contribution part. This fee is also used to "recover" direct costs the provider incurs for complying with FCC regulations and taxes, such as lawyers, form filing, and the resources needed to stay compliant.

As a provider dependant fee it can vary by quite a lot, depending on your base phone service fee. It can be anywhere from zero to hundreds of dollars.

Regulatory, Compliance and Intellectual Property Fee

Another term used by providers similar to this one is Compliance and Administrative Cost Recovery Fee. This is another one that is not government-mandated and is provider dependant. This fee is used by the provider to cover compliance costs related to federal/state/local legal reporting and filing requirements, and costs associated with acquiring and protecting intellectual property.

Providers may charge this as a fixed fee to all customers or as a percentage of the service bill. Not all providers charge this fee.

Federal Telcommunications Relay Service (TRS) Fund

Similar to the Federal USF described above all providers have to contribute to the Telecommunications Relay Service (TRS) Fund. The TRS is used to fund services for allowing persons with hearing or speech disabilities to place and receive telephone calls. Some states have their own TRS fund so you may see that also.

This fee is less common but some providers do pass this charge onto their customers. The way the Federal contribution is calculated changed recently for VoIP services (so intrastate and interstate revenues are used in the calculation now) meaning a large increase in the contributions by providers. This could mean that we see more providers passing this cost onto the customer.

Local Utility Users Tax

This is a telecommunications tax imposed by some states in the USA and varies by jurisdiction. It can imposed at a state and a local (County/City) level. So it will depend on your end location whether you see this on your quote or bill.

Depending on the state this can be between 0 and 11% of your service fees.

Other State Taxes

Every state in the USA has different telecommunication regulations and taxes which makes providing VoIP services a headache to administer. Some states include their own USF fees, Line fees, TRS fees, Excise Tax, District Tax, and Gross Receipts Tax. The provider is required to pay these fees and like other taxes they may pass these onto the customer.

California State Telecommunication Taxes

California requires a special mention here! It has the most complex tax requirements out of all the states in the USA. There are five (5) Public Utility Taxes/Fees alone as well as a local Utility Tax, Access Line Tax and a Universal Lifeline Tax.

Bear this in mind if you are trying to understand your bill and you live in California. There may be more than double the number of line items.

Important Facts

Now that we have discussed all the aspects of what goes into the pricing of your phone service let's consider some important facts:

- Providers advertise their lowest base service only rates.

- For home services this typically means the annual prepay option averaged over 12 months.

- For business services this can mean service pricing is based on 100+ users and a minimum 1 year agreement.

- The actual monthly rate will depend on many factors.

- The taxes and added fees are different for every provider.

- The cheapest advertised VoIP service does not always equate to the cheapest option.

Price Comparison Tips

If you are ready to switch to VoIP here are some of our tips on making the right decision:

- Make sure that all the service costs are included in your comparisons.

- We always recommend getting price quotes for business services so you can make an apples to apples comparison.

- Contact the provider directly to make sure you understand what your actual monthly cost will be.

- If you have a specific provider in mind ask about price matching if you have a cheaper quote.

Final Thoughts

This article's main objective was to explain VoIP service pricing and is intended to help in two ways. Firstly, if you are looking to make the switch to VoIP then we hope this article gives you an introduction to the true cost of VoIP and some insight into why comparing multiple providers is key in making the right decision.

Secondly, if you are an existing VoIP user we hope this provided a good explanation and breakdown of the line items that could be on your phone bill. Sometimes it is good to understand what we are paying for, but not always!

Some of the key take aways are that there are many factors that can affect the real cost of your VoIP solution, and these costs can vary between providers. For that reason we highly recommend getting price quotes to compare rather than just relying on advertised rates.

VoIP Taxes and Fees by State for the USA

As an additional resource the below provides some insights into requirements for VoIP taxes and fees associated with each state in the USA. Please note that these can change at any time and you take full responsibility for verifying any of the data provided below. The below is provided purely as an informational resource.

Please also note that exact fees for E911 may be adjusted locally, depending on city, county and state requirements.

Use the links below to jump straight to the state you are interested in or scroll through. The states are displayed in alphabetical order.

If you see different state, county, local or city taxes on your VoIP phone bill you can use our contact form below to send that info to us and we will add it here.

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington, DC

- West Virginia

- Wisconsin

- Wyoming

Alabama State VoIP Taxes and Fees

Alabama has an estimated population of 4.9 million, with its most populous city being Birmingham with approximately 210 thousand people.

| State Sales Tax | 4.0% |

| Utility Privilege License Tax | Varies |

| State E911 Fee | $1.86 |

Alaska State VoIP Taxes and Fees

Alaska has an estimated population of 740 thousand, with its most populous city being Anchorage with approximately 292 thousand people.

| State Universal Service Fee | 15.8% |

| State E911 Fee | $2.00 (Anchorage) |

| State Universal Access Surcharge | $0.09 |

Arizona State VoIP Taxes and Fees

Arizona has an estimated population of 7.2 million, with its most populous city being Phoenix with approximately 1.7 million people.

| State Sales Tax | 5.6% |

| Transaction Privilege Tax | State, County, City levels |

| State E911 Fee | $0.20 |

| State USF | $0.02 |

| Local License Tax | Flagstaff, Nogales, Tucson |

Arkansas State VoIP Taxes and Fees

Arkansas has an estimated population of 3.1 million, with its most populous city being Little Rock with approximately 200 thousand people.

| State Sales Tax | 6.5% |

| Federal Excise Tax | 3.0% |

| High Cost Fund Assessment | Varies |

| County/City Sales Tax | Varies by Location |

| State E911 Fee | $1.30 |

| State TRS Surcharge | $0.02 |

| State Telecom Surcharge | $0.02 |

California State VoIP Taxes and Fees

California has an estimated population of 40 million, with its most populous city being Los Angeles with approximately 4 million people.

| State Sales Tax | 6.25% |

| Telecommunications Fund | 1.08% |

| State CASF | 0.464% |

| State PUC | 0.18% |

| State HCF (PartA ) | 0.35% |

| State TRS | 0.5% |

| Local Utility Tax | 0 to 11.0% |

| Access Line Tax | For select cities |

| Universal Lifeline Tax | 4.75% |

| State E911 Fee | 0.75% |

Colorado State VoIP Taxes and Fees

Colorado has an estimated population of 5.7 million, with its most populous city being Denver with approximately 620 thousand people.

| State Sales Tax | 2.9% |

| City Tax | 0.1% to 4.5% |

| State TRS | $0.06 per line |

| State USF | Varies |

| Local Telecomms Business Tax | Varies |

| Regional Transportation District Sales Tax | 1.0% |

| Scientific and Cultural Facilities District Sales Tax | 0.1% |

| State E911 Fee | $0.45 to $1.75 |

| State TRS Fund | $0.06 |

Connecticut State VoIP Taxes and Fees

Connecticut has an estimated population of 3.6 million, with its most populous city being Bridgeport with approximately 145 thousand people.

| State Sales Tax | 6.35% |

| State TRS | 0.07% |

| State E911 Fee | $0.68 |

Delaware State VoIP Taxes and Fees

Delaware has an estimated population of 970 thousand, with its most populous city being Wilmington with approximately 71 thousand people.

| Public Utility Excise Tax | 4.25% |

| State E911 Fee | $0.60 |

| State TRS Surcharge | $0.02 |

Florida State VoIP Taxes and Fees

Florida has an estimated population of 21.3 million, with its most populous city being Jacksonville with approximately 905 thousand people.

| State Sales Tax | 6.0% |

| County Sales Tax | 1.0% |

| State Communications Tax | 6.8% |

| County/Local Communications Tax | 0 to 7.0% |

| State Gross Receipts Tax | 2.37% |

| State E911 Fee | $0.40 |

Georgia State VoIP Taxes and Fees

Georgia has an estimated population of 10.6 million, with its most populous city being Atlanta with approximately 500 thousand people.

| State Sales Tax | 4.0% |

| County/Local Sales Tax | 0 to 4.0% |

| State E911 Fee | $1.50 |

| 911 Cost Recovery Fee | $0.45 |

Hawaii State VoIP Taxes and Fees

Hawaii has an estimated population of 1.4 million, with its most populous city being Honolulu with approximately 350 thousand people.

| State Sales Tax | 4.0% |

| County/Local Sales Tax | 0 to 2.0% |

| State Gross Receipts Tax | 4.0% |

| County/Local Gross Receipts Tax | 0 to 1.885% |

| State E911 Fee | $0.66 |

Idaho State VoIP Taxes and Fees

Idaho has an estimated population of 1.8 million, with its most populous city being Boise with approximately 230 thousand people.

| State Sales Tax | 6.0% |

| State E911 Fee | $1.00 to $1.25 |

Illinois State VoIP Taxes and Fees

Illinois has an estimated population of 12.8 million, with its most populous city being Chicago with approximately 2.7 million people.

| State Sales Tax | 6.25% |

| State Communications Tax | 7.0% |

| Local Communications Tax | 7.0% |

| State Gross Receipts Tax | 0.5% |

| Telecommunications Infrastructure Maintenance Fee | 0.6% |

| State E911 Fee | $1.50 $5.00 City of Chicago |

| State TRS Fee | $0.02 |

Indiana State VoIP Taxes and Fees

Indiana has an estimated population of 6.7 million, with its most populous city being Indianapolis with approximately 870 thousand people.

| State Sales Tax | 7.0% |

| State Gross/Utility Receipts Tax | 1.4% |

| State Universal Service Fund | 0.6% |

| State E911 Fee | $1.00 |

| State TRS Surcharge | $0.03 |

Iowa State VoIP Taxes and Fees

Iowa has an estimated population of 3.2 million, with its most populous city being Des Moines with approximately 220 thousand people.

| State Sales Tax | 6.0% |

| County Sales Tax | 1.0% to 2.0% |

| State E911 Fee | $1.00 |

| State TRS Fee | $0.03 |

Kansas State VoIP Taxes and Fees

Kansas has an estimated population of 3.0 million, with its most populous city being Wichita with approximately 390 thousand people.

| State Sales Tax | 6.15% |

| County/City Sales Tax | 0.3% |

| State Universal Service Fund | 6.88% |

| State E911 Fee | $0.90 |

| Local Telecomm Service Occupation Tax | $1.80 for Wichita |

Kentucky State VoIP Taxes and Fees

Kentucky has an estimated population of 4.5 million, with its most populous city being Louisville with approximately 620 thousand people.

| State Sales Tax | 6.0% |

| State Gross Receipts Tax | 1.3% |

| County School District Tax | 3.0% |

| State E911 Fee | $0.32 to $4.00 |

Louisiana State VoIP Taxes and Fees

Louisiana has an estimated population of 4.7 million, with its most populous city being New Orleans with approximately 400 thousand people.

| State Sales Tax | 4.0% |

| State Sales Tax (International Usage) | 3.0% |

| State Telecommunications Sales Tax | 3.0% |

| County/Local Sales Tax | 0.5% |

| State E911 Fee | $0.38 to $2.00 |

Maine State VoIP Taxes and Fees

Maine has an estimated population of 1.4 million, with its most populous city being Portland with approximately 67 thousand people.

| State Sales Tax | 5.5% |

| Service Provider Tax | 6.0% |

| State ConnectME Line Tax | $0.10/line |

| State Universal Service Fund | $0.44 |

| State E911 Fee | $0.35 |

| State TEAF | $0.21 |

Maryland State VoIP Taxes and Fees

Maryland has an estimated population of 6 million, with its most populous city being Baltimore with approximately 600 thousand people.

| State Sales Tax | 6.0% |

| Anne Arundel County Utility Tax | 8.0% |

| Local Baltimore Telephone Tax | $4.00/line |

| Montgomery County Utility Tax | $2.00/line |

| State E911 Fee | $1.00 |

| State Telecom Access Fee | $0.05 |

Massachusetts State VoIP Taxes and Fees

Massachusetts has an estimated population of 6.9 million, with its most populous city being Boston with approximately 700 thousand people.

| State Sales Tax | 6.25% |

| State E911 Fee | $1.50 |

Michigan State VoIP Taxes and Fees

Michigan has an estimated population of 10 million, with its most populous city being Detroit with approximately 675 thousand people.

| State Sales Tax | 6.0% |

| State E911 Fee | $0.25 for State $0 to $3 by County |

Minnesota State VoIP Taxes and Fees

Minnesota has an estimated population of 5.6 million, with its most populous city being Minneapolis with approximately 425 thousand people.

| State Sales Tax | 6.0% |

| County/City Sales Tax | Varies |

| Local Transit Tax | 0 to 1.0% |

| State E911 Fee | $0.95 |

Mississippi State VoIP Taxes and Fees

Mississippi has an estimated population of 3 million, with its most populous city being Jackson with approximately 165 thousand people.

| State Sales Tax | 7.0% |

| Local Sales Tax | 1.0% for Tupelo |

| State E911 Fee | $1.00 |

Missouri State VoIP Taxes and Fees

Missouri has an estimated population of 6.2 million, with its most populous city being Kansas City with approximately 500 thousand people.

| State Sales Tax | 4.225% |

| PSC Assessment | 0.13% |

| County/Local Sales Tax | 0 to 6.0% |

| City Emergency License Tax | 4.0% |

| City Local License Tax | Varies |

| District Sales Tax | Varies |

| State E911 Fee | Up to $1.00 Location dependant |

| State TRS Surcharge | $0.04 |

Montana State VoIP Taxes and Fees

Montana has an estimated population of 1.1 million, with its most populous city being Billings with approximately 110 thousand people.

| State Telecom Excise Tax | 5.0% |

| State TRS Surcharge | $0.10 |

| State E911 Fee | $1.00 |

Nebraska State VoIP Taxes and Fees

Nebraska has an estimated population of 2 million, with its most populous city being Omaha with approximately 470 thousand people.

| State Sales Tax | 5.5% |

| County/Local Sales Tax | 0 to 4.0% |

| Nebraska Universal Service Fund | $1.75/line |

| TRS Surcharge | $0.03/line |

| State E911 Fee | $0.50 to $1.00 |

Nevada State VoIP Taxes and Fees

Nevada has an estimated population of 3 million, with its most populous city being Las Vegas with approximately 650 thousand people.

| State Sales Tax | 4.6% |

| County/Local Sales Tax | 0 to 4.6% |

| Local Gross Receipts Tax | 0 to 5.0% |

| State Universal Service | 0.0956% |

| State TRS Surcharge | $0.06/line |

New Hampshire State VoIP Taxes and Fees

New Hampshire has an estimated population of 1.4 million, with its most populous city being Manchester with approximately 113 thousand people.

| State Utility Tax | 7.0% |

| State E911 Fee | $0.75 |

| State TRS Surcharge | $0.06/line |

New Jersey State VoIP Taxes and Fees

New Jersey has an estimated population of 9 million, with its most populous city being Newark with approximately 285 thousand people.

| State Sales Tax | 6.63% |

| State E911 Fee | $0.90 |

New Mexico State VoIP Taxes and Fees

New Mexico has an estimated population of 2.1 million, with its most populous city being Albuquerque with approximately 560 thousand people.

| State Sales Tax | 5.125% |

| County/Local Sales Tax | 0 to 4.5% |

| State USF | $0.88/line |

| State E911 Fee | $0.51 |

New York State VoIP Taxes and Fees

New York has an estimated population of 20 million, with its most populous city being New York City with approximately 8.5 million people.

| State Sales Tax | 4.0% |

| County/City Sales Tax | 0 to 4.5% |

| Metropolitan Commuter Transportation District | 0.375% |

| State Excise Tax | 2.5% |

| State Gross Receipts Tax | 0.375% |

| New York City Local Franchise Tax | 2.35% |

| State E911 Fee | $0.35 to $1.00 |

North Carolina State VoIP Taxes and Fees

North Carolina has an estimated population of 10.5 million, with its most populous city being Charlotte with approximately 875 thousand people.

| State Sales Tax | 7.0% |

| County/Local Sales Tax | 0 to 2.0% |

| State E911 Fee | $0.65 |

North Dakota State VoIP Taxes and Fees

North Dakota has an estimated population of 760 thousand, with its most populous city being Fargo with approximately 125 thousand people.

| State Sales Tax | 5.0% |

| County/Local Sales Tax | 0 to 2.0% |

| State E911 Fee | $1.50 to $2.00 |

Ohio State VoIP Taxes and Fees

Ohio has an estimated population of 11.7 million, with its most populous city being Columbus with approximately 895 thousand people.

| State Sales Tax | 5.75% |

| County/Local Sales Tax | 0 to 2.5% |

| Federal Excise Tax | 3.0% |

Oklahoma State VoIP Taxes and Fees

Oklahoma has an estimated population of 4 million, with its most populous city being Oklahoma City with approximately 650 thousand people.

| State Sales Tax | 4.5% |

| County/Local Sales Tax | 0 to 2.5% |

| State USF | 6.28% |

| State E911 Fee | $0.75 |

Oregon State VoIP Taxes and Fees

Oregon has an estimated population of 4.2 million, with its most populous city being Portland with approximately 655 thousand people.

| Local Utility Tax | 0 to 7.0% |

| RSPF Surcharge | $0.10/line |

| State E911 Fee | $1.00 |

Pennsylvania State VoIP Taxes and Fees

Pennsylvania has an estimated population of 12.8 million, with its most populous city being Philadelphia with approximately 1.6 million people.

| State Sales Tax | 6.0% |

| State Gross Receipts Tax | 5.0% |

| County/Local Sales Tax | 2.0% - Philadelphia 1.0% - Allegheny County |

| State E911 Fee | $1.65 |

Rhode Island State VoIP Taxes and Fees

Rhode Island has an estimated population of 1.1 million, with its most populous city being Providence with approximately 180 thousand people.

| State Sales Tax | 7.0% |

| Public Services Corporation Gross Earnings Tax | 5.0% |

| State Education Access Fund | $0.26/line |

| State E911 Fee | $1.00 |

South Carolina State VoIP Taxes and Fees

South Carolina has an estimated population of 5.1 million, with its most populous city being Charleston with approximately 140 thousand people.

| State Sales Tax | 6.0% to 7.0% |

| State USF | 2.18% |

| County Sales Tax | Varies |

| District Tax | 0 to 1.0% |

| School District Tax | 0 to 1.0% |

| Development District Tax | 0 to 1.0% |

| Local Business license Tax | 0 to 1.0% |

| State E911 Fee | $0.45 to $1.00 |

| Dual Party Relay Charge | $0.03/line |

South Dakota State VoIP Taxes and Fees

South Dakota has an estimated population of 885 thousand, with its most populous city being Sioux Falls with approximately 180 thousand people.

| State Sales Tax | 4.0% |

| County/Local Sales Tax | 0 to 2.0% |

| State E911 Fee | $1.25 |

Tennessee State VoIP Taxes and Fees

Tennessee has an estimated population of 6.8 million, with its most populous city being Nashville with approximately 670 thousand people.

| State Sales Tax | 7.0% |

| State Sales Tax (International Usage) | 8.5% |

| County/Local Sales Tax | 0 to 2.75% |

| State E911 Fee | $1.16 |

Texas State VoIP Taxes and Fees

Texas has an estimated population of 28.7 million, with its most populous city being Houston with approximately 2.4 million people.

| State Sales Tax | 6.25% |

| Local Sales Tax | Varies |

| State E911 Fee | $0.50 |

| County/Local E911 Fee | Varies |

Utah State VoIP Taxes and Fees

Utah has an estimated population of 3.2 million, with its most populous city being Salt Lake City with approximately 200 thousand people.

| State Sales Tax | 4.85% |

| City/Local Sales Tax | 0 to 3.5% |

| Municipal Telecom License Tax | 0 to 3.5% |

| State USF | $0.60 |

| State E911 Fee | $0.77 |

| Local E911 Fee | $0.71 |

Vermont State VoIP Taxes and Fees

Vermont has an estimated population of 630 thousand, with its most populous city being Burlington with approximately 43 thousand people.

| State Sales Tax | 6.0% |

| City Sales Tax | 0 to 1.0% |

Virginia State VoIP Taxes and Fees

Virginia has an estimated population of 8.5 million, with its most populous city being Virginia Beach with approximately 450 thousand people.

| State Communications Sales Tax | 5.0% |

| State E911 Fee | $0.75 |

Washington State VoIP Taxes and Fees

Washington has an estimated population of 7.5 million, with its most populous city being Seattle with approximately 750 thousand people.

| State Sales Tax | 6.5% |

| County/Local Sales Tax | 0 to 4.0% |

| State B&O Tax | 0.471% |

| Local Utility Tax | 0 to 6.0% |

| State E911 Fee | $0.25 |

| County/Local E911 Fee | $0.70 |

Washington, DC State VoIP Taxes and Fees

Washington, DC has an estimated population of 705 thousand, with its most populous city being Washington with approximately 705 thousand people.

| State Sales Tax | 6.0% |

| Local Sales Tax | 0 to 2.75% |

| State Gross Receipts Tax | 11.0% |

| State USF | 0.701% |

| State E911 Fee | $0.76 |

West Virginia State VoIP Taxes and Fees

West Virginia has an estimated population of 1.8 million, with its most populous city being Charleston with approximately 47 thousand people.

| State Sales Tax | 6.0% |

| State E911 Fee | $0.98 to $8.96 Varies by County |

Wisconsin State VoIP Taxes and Fees

Wisconsin has an estimated population of 5.8 million, with its most populous city being Milwaukee with approximately 595 thousand people.

| State Sales Tax | 5.0% |

| Local Sales Tax | 0 to 0.5% |

| State USF | 0.023% |

| TEACH/UW-System/DPI | 0.27% |

| State E911 Fee | $0.75 |

Wyoming State VoIP Taxes and Fees

Wyoming has an estimated population of 580 thousand, with its most populous city being Cheyenne with approximately 65 thousand people.

| State Sales Tax | 4.0% |

| State USF | 1.7% |

| PUC Fee | 0.3% |

| State E911 Fee | $0.25 to $0.75 |

| Relay Special Fee | $0.09 |